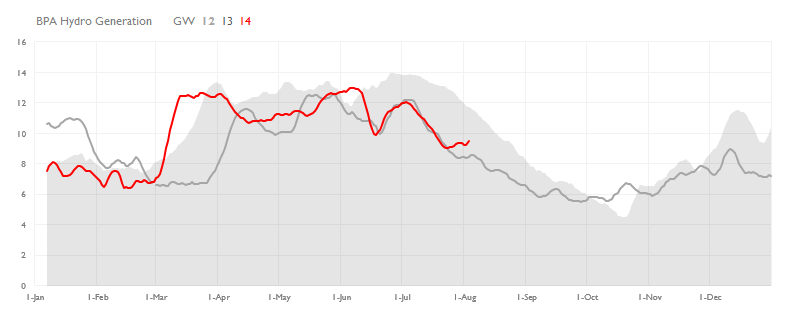

Despite the drought conditions prevailing in the Southwest, a combination of low flows last year and better hydrological conditions in the Pac NW is resulting in higher electric generation than 2013.

California's daily hydro output is marginally below 2013:

Meanwhile the much more powerful Columbia river is driving higher output up north recently:

Tuesday, July 29, 2014

May 2014 Electric Power Monthly

US power generation in May was comparable to last year, at 10.42 vs 10.39 GWhD. Weather was comparable, as '14 had +9CDD and -10HDD vs '13.

Electric Power Monthly

By feedstock, there were slight absolute losses for coal, and a 5% gain for natural gas. Nuclear was off slightly, as were renewables.

Hydropower fell to a 4 year low, down 8% over '13, and solar hit another high in what should be another year of uninterrupted monthly records.

Electric Power Monthly

By feedstock, there were slight absolute losses for coal, and a 5% gain for natural gas. Nuclear was off slightly, as were renewables.

Hydropower fell to a 4 year low, down 8% over '13, and solar hit another high in what should be another year of uninterrupted monthly records.

Monday, July 28, 2014

Mexico Oil and Gas Production: Drastic Oil Declines in June

Mexican oil production took a steep dive in June, falling more than 50K BOPD vs prior month, to a modern low of 2,796 MBOPD. Losses were concentrated in heavy oil, and offshore, production.

Natural gas production was steady, at about 6.5 BCFD.

Weather Unsupportive for Natural Gas

National cooling demand looks to be lower than normal for the third week in a row, and the mid-range forecast does not look much better. The primary gas consuming states are all above average this week however (with the exception of Louisiana).

Monday, July 7, 2014

More Heat Forecast for Current Week, Last Week Cooler than Expected

Well, last week's forecast for major heat did not materialize. Actuals came in much lower than forecast, at 73CDD. The current week is expected to be warmer than normal, at 85 CDD vs a normal of 71.

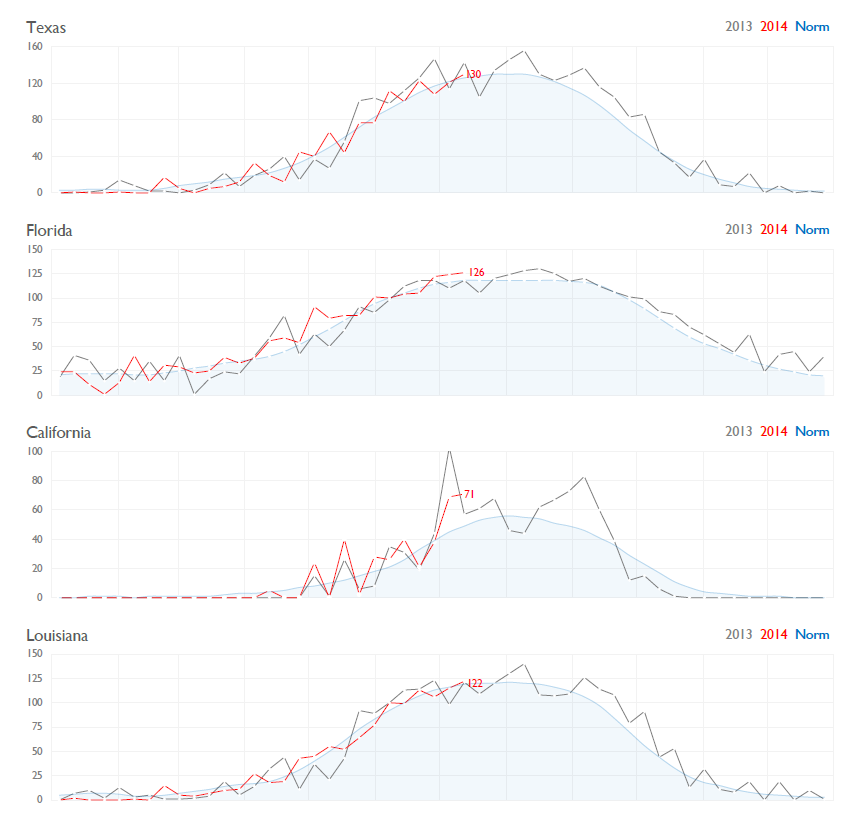

Cooling Degree Day ReportOn a state by state basis for the major gas consuming states, Florida and California look warm, with Texas and Louisiana near normal.

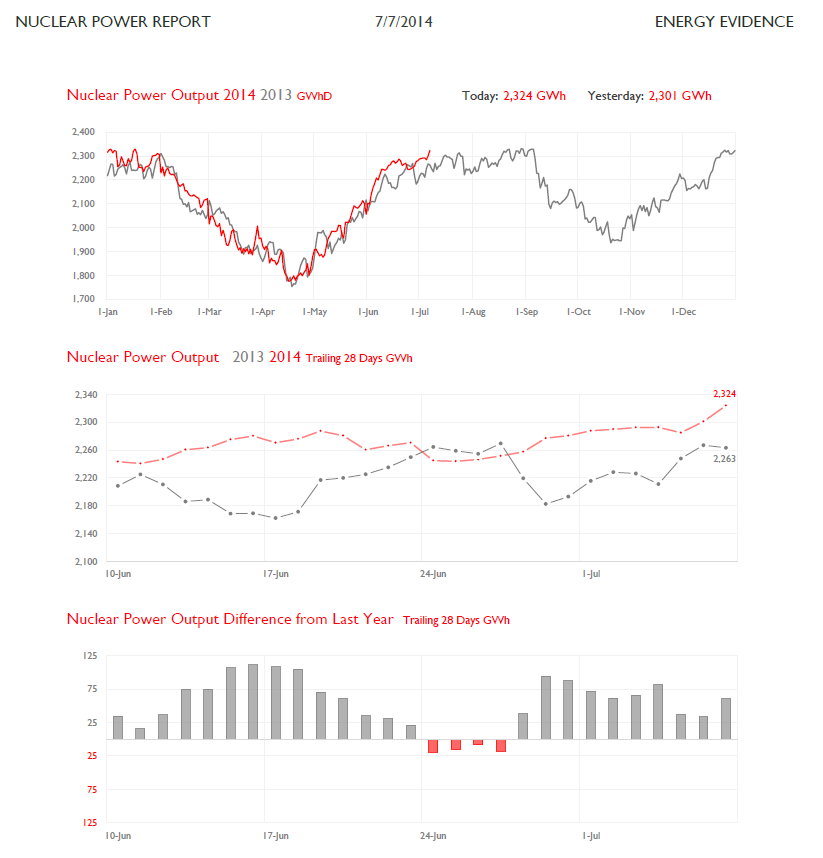

Strong Nuclear Power Output Offsetting Natural Gas Demand

With all but one nuclear reactor generating near 100% today, output is surpassing last year for the tenth day in a row, averaging nearly 1/2 BCF of natural gas demand offset. This differential should shrink over the next two months, since output cannot improve much from here. The nuclear fleet is performing near perfectly, and barring unplanned outages should help suppress natural gas demand this summer.

Nuclear Power ReportThursday, July 3, 2014

Wind Generation in Texas (ERCOT Region)

The month of June ended with very steady and strong wind generation in Texas, as output held near 9,000 MW for four days straight. That helped June average 5.45 GW of wind output, vs 4.70 GW last year and 3.66 GW in 2012.

With significant additional generating resources installed at the beginning of the year, output should reflect that capacity growth through the summer, though July-Sep is historically low.

With significant additional generating resources installed at the beginning of the year, output should reflect that capacity growth through the summer, though July-Sep is historically low.

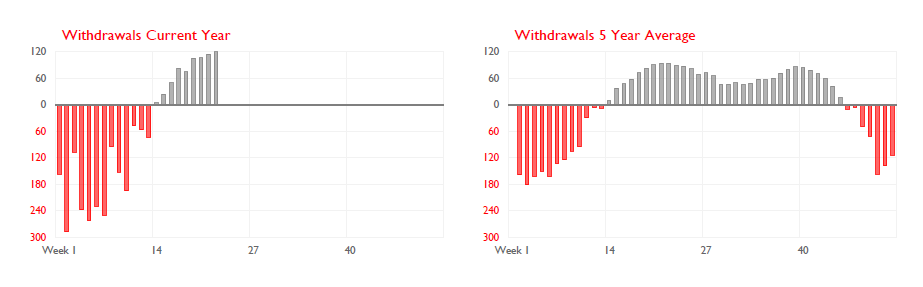

EIA Natural Gas Storage Report: +100 BCF (Near Expectations)

While today's storage injection of 100 BCF did not surprise, gas prices did, rising about 4 to 5 cents after the news:

Natural Gas Weekly Storage Report

Storage comparisons tightened considerably, as the deficit to the 5 year average shrank by 32 BCF to a -790 BCF level, and storage is now 666 BCF below last year, declining by 24 BCF this week.

Natural Gas Weekly Storage Report

Storage comparisons tightened considerably, as the deficit to the 5 year average shrank by 32 BCF to a -790 BCF level, and storage is now 666 BCF below last year, declining by 24 BCF this week.

Tuesday, July 1, 2014

Western Canada: Natural Gas Production and Storage Rebounding

June has seen Alberta NG production spike after a maintenance curtailment, and is currently running 800MMCF above last year. This is helping storage recover, despite exports to the US that match 2013.

Monday, June 30, 2014

Significant Heat Forecast for Current Week: 83 CDD vs 66 CDD Norm

This week is forecast to be warmer than all but two of last year's summer weeks, at 83 CDD.

Cooling Degree Day Report

Among the major gas-fired electricity consuming states, all are above normal but California is drastically above, though the similar week last year was even warmer there.

Cooling Degree Day Report

Among the major gas-fired electricity consuming states, all are above normal but California is drastically above, though the similar week last year was even warmer there.

Thursday, June 26, 2014

EIA Natural Gas Weekly Storage: +110 BCF

Another massive storage anomaly this week, as an injection of +110 BCF was reported by EIA for the week ended June 20. It sent gas futures down a steep 11 cents, as the storage number was about 5 BCF above the average estimates.

Natural Gas Weekly Storage Report

Comparisons with prior periods improved, as the variance with the 5 year average fell from 851 to 822 BCF below, and from 706 to 690 vs last year.

Natural Gas Weekly Storage Report

Comparisons with prior periods improved, as the variance with the 5 year average fell from 851 to 822 BCF below, and from 706 to 690 vs last year.

EIA Weekly Petroleum Report: A Weaker Picture this Week

EIA reported increases in crude, gasoline, and diesel inventories this week. Overall, stocks remain high for crude, average for gasoline, and low for distillate.

Regionally, stocks increased in the closely watched Cushing, OK storage region and the gulf coast, leaving Cushing well below the historical range, and gulf coast well above.

Demand showed weakness in both gasoline and diesel, with weekly gasoline demand falling below the 5 year range, and distillate falling for the 4th week in a row to the middle of the range:

Regionally, stocks increased in the closely watched Cushing, OK storage region and the gulf coast, leaving Cushing well below the historical range, and gulf coast well above.

Demand showed weakness in both gasoline and diesel, with weekly gasoline demand falling below the 5 year range, and distillate falling for the 4th week in a row to the middle of the range:

Tuesday, June 17, 2014

Texas (ERCOT) Electricity Generation and Demand: May 2014

ERCOT total generation in May 2014 was almost identical to May 2013, at 882 vs 884. Fossil fuels did however take a larger share of the generation pie, up to 77.7% from 72.6%.

Coal was responsible for slightly more generation than Natural Gas in May, at 50.4% vs 49.6% for Natural Gas. That too was comparable to May 2013.

Friday, June 13, 2014

Baker Hughes Rig Counts: Oil Gains (+6) Gas Loses (-10)

Baker Hughes rig counts released today show Oil rig power up to a new multi-year high at 1,019 horizontal rigs, a gain of six horizontals on the week. Gas rig power weakened notably, as horizontals fell -8 to a new low of 299 horizontal rigs working.

The Permian returned to its oil dominated march upward, gaining 4 new horizontal oil rigs:

Other notable changes included a new high in oil rigs in the DJ Basin:

Overall oil and gas activity has increased on a multi-week trend in the Granite Wash:

Drilling continues its seasonal recovery in Canada, though oil has rebounded much more than gas, both in Canada as a whole and Alberta particularly:

Full Reports:

Rig Count Summary

Rig Count by Basin

Rig Count by State

Canada Rig Counts

Thursday, June 12, 2014

EIA Natural Gas Storage Report: Bullish +107 BCF Injection Reported

Markets were pleased to see the first injection to come in below estimates in many weeks. Analysts were tightly clustered around +112 BCF. The +107 report sent gas up more than 18 cents on the day to $4.69.

Natural Gas Weekly Storage ReportAgainst the 5 year average, inventories now stand 877 BCF below, and against last year 727 BCF below:

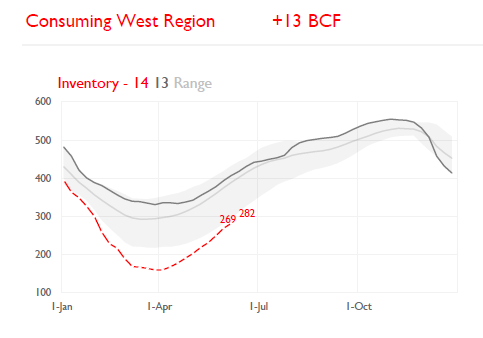

Regional inventories varied, with the Consuming West near the low end of the historical range, while storage was much below the range in both the Producing and Consuming East regions:

The shoulder season is rapidly drawing to a close, bring to an end the best opportunity to rebuild storage at an exceptional rate. The inventory shortfall will have a more difficult time closing from here through November, and storage is projected to top out at less than 3.3 TCF, which may pose a challenge as winter approaches and push prices back above $5.00.

Wednesday, June 11, 2014

EIA Petroleum Weekly Report: Demand Slows Abruptly

Inventory

Commercial crude oil inventories fell by 2.6 million barrels this week, alongside a comparable rise in refined fuel inventories with Gasoline up 1.7 M and Diesel up 0.9 M.

EIA Weekly Petroleum Inventory

Regional crude inventories in the important Cushing and Gulf Coast locations fell slightly, with Cushing remaining well below historical levels and Gulf Coast well above:

Demand

Demand was tepid last week, falling below the recent trend for both gasoline and diesel. Both products recorded levels comparable to last year, and near the low end of the 5 year range.

EIA Weekly Petroleum Demand

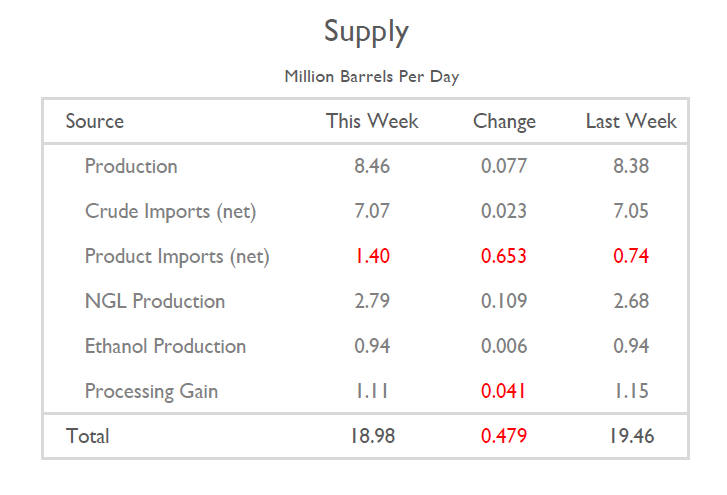

Supply

Supply recovered from last week's maintenance-driven decline. Net imports were down on the week, driven primarily by increased product exports.

EIA Weekly Petroleum Supply

Commercial crude oil inventories fell by 2.6 million barrels this week, alongside a comparable rise in refined fuel inventories with Gasoline up 1.7 M and Diesel up 0.9 M.

EIA Weekly Petroleum Inventory

Regional crude inventories in the important Cushing and Gulf Coast locations fell slightly, with Cushing remaining well below historical levels and Gulf Coast well above:

Demand

Demand was tepid last week, falling below the recent trend for both gasoline and diesel. Both products recorded levels comparable to last year, and near the low end of the 5 year range.

EIA Weekly Petroleum Demand

Supply

Supply recovered from last week's maintenance-driven decline. Net imports were down on the week, driven primarily by increased product exports.

EIA Weekly Petroleum Supply

Tuesday, June 10, 2014

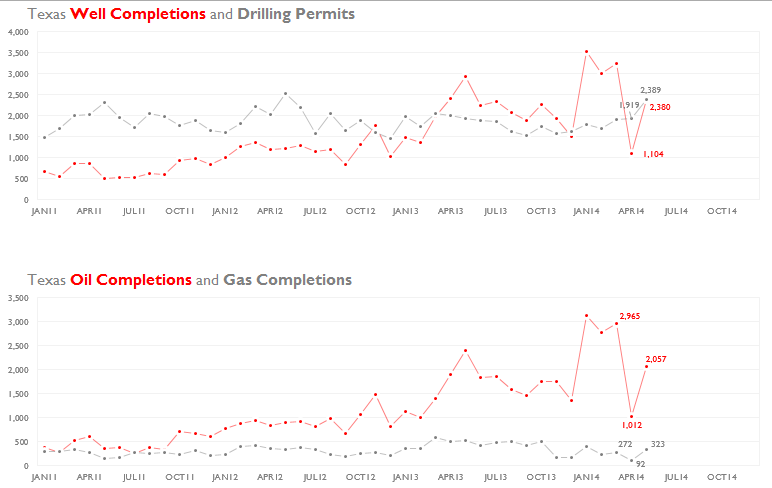

Texas Drilling and Permitting Activity Up in May

The Texas Railroad Commission issued the May Drilling, Completion, and Permitting Report which saw a rebound in well completions and an uptick in permits. Reported well completions typically suffer from backlog and latency issues, and April completions were exceptionally low.

The strength in drilling permits continued the six month trend upward, which augurs well for production. 5 of every 6 wells were completed as oil wells, but the total gas well completion count rose noticeably to 323 in May.

Monday, June 9, 2014

Cooling Requirements Above Normal Again

NOAA expects another week of above normal cooling requirements in the US, will all the major gas consuming states expecting a positive anomaly. Overall demand is expected to be 57 CDD vs a Normal of 45 and last year's reading of 52:

The states with the largest summer gas-fired electricity demand. California shows the highest anomaly this week:

Saturday, June 7, 2014

Rig Counts: Oil Rigs Flat, Gas Down 6 Rigs

Baker Hughes rig counts showed oil rigs unchanged for the week, though verticals dropped by 14 and directionals rose by 13. Gas rig counts were down 6, but 5 of those lost rigs were in offshore and inland waters, so shale basins changed little in total.

In Canada, oil rigs recovered seasonally in Saskatchewan, but both oil and gas rig counts in Alberta were little changed.

Full Reports:

Rig Count Summary

Rig Count by Basin

Rig Count by State

Canada Rig Counts

Thursday, June 5, 2014

EIA Natural Gas Storage Report: Large +119 BCF Injection

Today's storage injection of 119 BCF exceeded estimates of about 112-118, sending gas prices down steeply. Prices quickly recovered to even. The storage deficit to the 5 year average closed to within 896 BCF, and the deficit to last year contracted to -737 BCF.

Natural Gas Weekly Storage Report

From this point, average injections begin to taper through the summer heat, and we may have now seen the largest injection that 2014 will witness. Next week's injection is projected to be near 100, but summer heat should mute the injections for the next three months, and the targeted season-end storage remains near 3.2 TCF.

Subscribe to:

Posts (Atom)