With each day that gas prices remained elevated compared to last year, the short term effects of hedging, contract commitments, and other temporary factors wear off, and we begin to see the fundamental economics for power generation. Yesterday ERCOT reported it's fuel mix for December, and natural gas lost more than 1.3 BCFE per day to coal.

In MISO, the numbers reveal themselves daily, and the impact is also more than 1 BCFE per day. This suggests that the total impact of switching must be in the 5+ BCFE per day range nationwide.

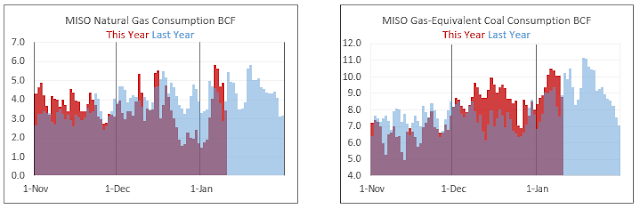

Here's a look at the daily effects in MISO. First of all, we see that the daily thermal power demand in December was comparable, year on year. To wit, it was about 364 BCFE in Dec 2015, and 370 BCFE in 2016. Close enough for government work:

That thermal generation demand was split between Natural Gas and Coal as follows:

On a gas/coal marketshare % basis, gas loses out big, except during the recent sharp (and not to be repeated?) cold snap:

This is all going to be compounded in the coming weeks by the low power demand due to warmth. It will flow through to storage projections, and to price I'm afraid, in a profound way.